Mumbai Realty – Housing demand remains unabated

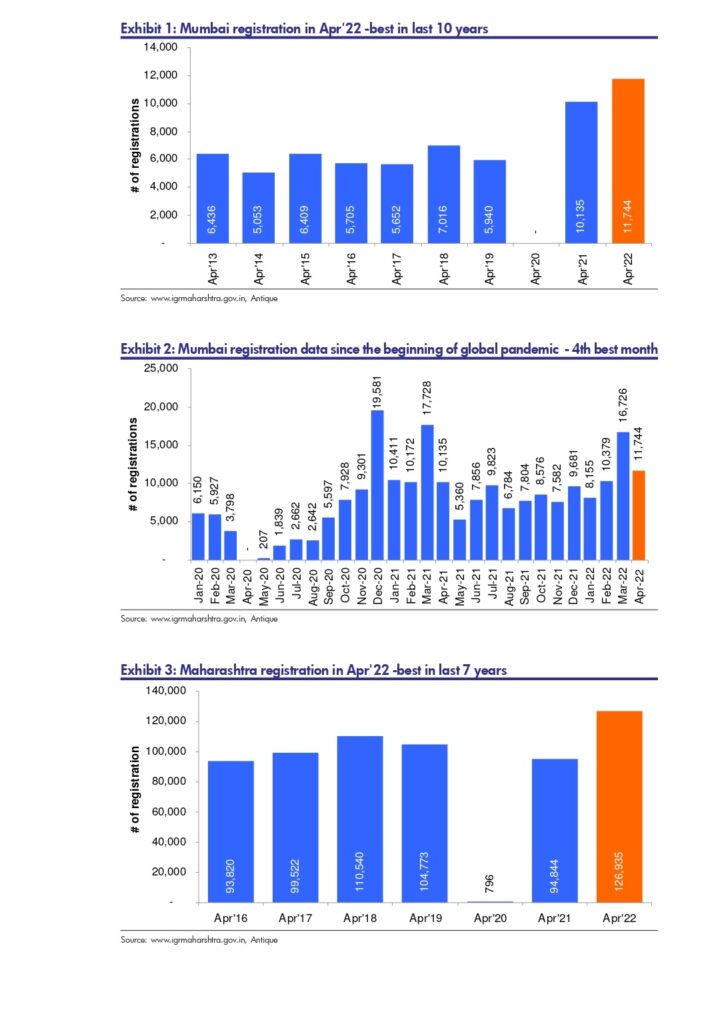

Property registrations data continued to show strength with Apr’22 turning

out to be the best April in last 10 years at 11,744 registrations (although

there could’ve some spill over from March); a decline of 30% MoM and in

our view, Mar’22 saw the positive impact of preponing of home registration/

home buying on account of increased stamp duty which was effective starting

Apr’22. On a positive side, number of registrations in Apr’22 stood at 2x last

5 year average of April month indicating robust housing demand driven by

favorable macros. Further, we reiterate our view on the continuation of

strong momentum both in demand and supply as we further move into CY22

driven by sector tailwinds.

Mumbai homes registrations continue to witness robust numbers

Apr’22 turned out to be the best April month in last 10 years in terms of number of registration

in Mumbai indicating strong appetite of home buyers. Strong registration data for Apr’22 for

Mumbai at 11,744 is a 16% rise over Apr’21; pre-COVID the monthly registrations were at ~

6,500. The data suggest continued momentum in housing demand in the wake of the supportive

underlying macros. Although, increase in upfront cost like rise in stamp duty by 1% is a

negative factor to the sector to some extent, but we believe that strong macros and favorable

condition such as improved affordability and low mortgage rates remain key stimuli to home

buying decision for consumers. We continue to believe that the robust demand in residential

segment will continue for the rest of the year which will further be accelerated by large supply

expected in next 2-3 years on the back of record premium collection by BMC in CY2022 at

INR147.5bn (as per media reports) almost 4.2x of average premium collection of INR35.0bn/

year. Assuming 80% of the supply hits the market in next 2 years, new launches expected to

be> 60,000 units per year for next 2 years (in CY2019 new launches were ~ 19,000 units).

Further, registration data for Maharashtra also continues to remain strong in line with Mumbai

with Apr’22 as the best April month in last 7 years in terms of home registration.

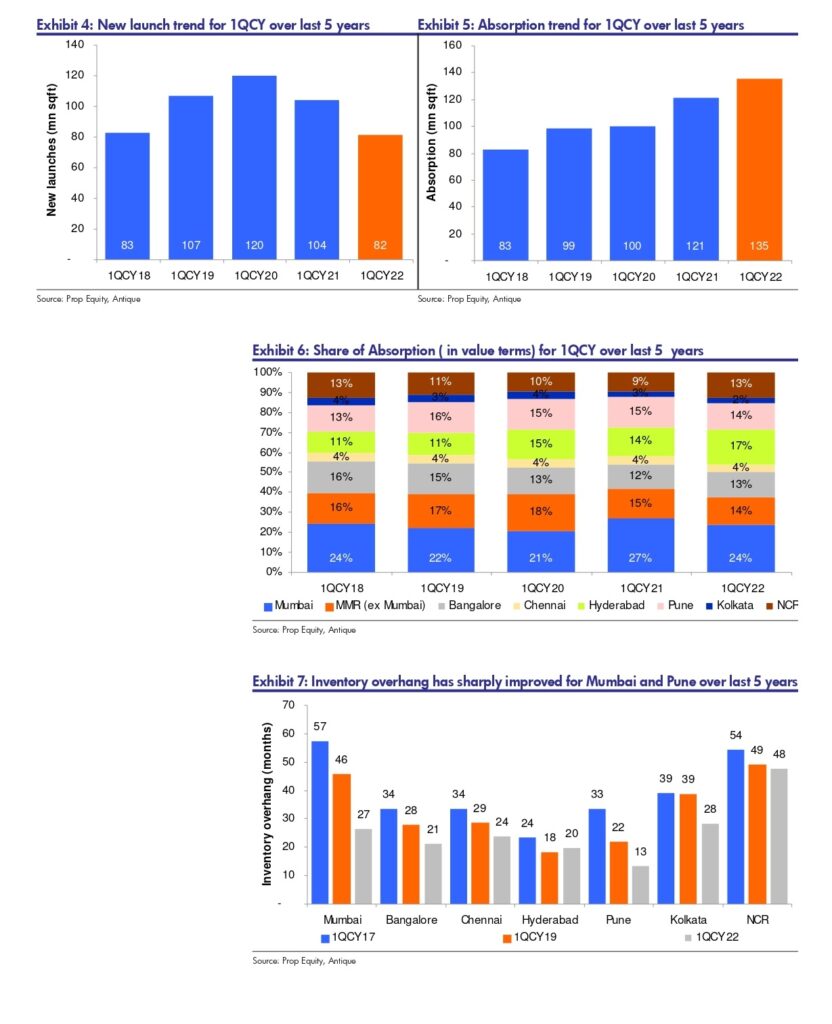

Inventory overhang remains at healthy level of 27 months

Measured supply and consistently strong demand in India’s largest housing market, Mumbai,

has been driving the efficiency in the housing macros with inventory overhang at decadal

low of ~27 months. Mumbai has seen an improvement in demand driving sharp improvement

in inventory overhang by 54% to 27 months in 1QCY22 vs. 57 months in 1QCY17. We

expect the demand to remain strong and calibrated price hikes across select projects by

Grade A developers to absorb commodity cost inflation; the price hikes might drive fence

sitters to accelerate home buying decision to avoid home purchases at heightened price.

Grade A developers accounted for ~ 30% of new launches in 1QCY22

1QCY22 witnessed ~18 mn sqft of new project launches across Thane and Mumbai (according

to Prop Equity data). Grade A developers accounted for ~30% of the new project launches

indicating strong wave of underlying consolidation on the supply side. However, with record

premiums paid by developers in CY22, we expect Tier 2 and 3 developers to re-enter the

market with incremental supply. Further, being a consumer driven housing upcycle, mid income housing is expected to take the center stage in the new project launches and the

same is visible in the share of ~50% of new launches coming from mid-income housing in

1QCY22 in Thane and Mumbai.

Macrotech Developers remains the best placed to benefit from its well

entranced presence in MMR and ability to strike JDA/JV deals owing to strong

execution track record